| |

Volume 4 | Issue 2 Autumn 2020 | | | |

WELCOME TO OUR AUTUMN NEWSLETTER | | | |

| |

The Credit Union for employees and retirees of South Dublin | Fingal | Dun Laoghaire-Rathdown County Councils | | | |

| |

We have some exciting news and offers for you which we hope you will welcome and enjoy.

Annual General Meeting 2020 Our AGM is normally held in early December each year however this year we expect the AGM to be delayed while we consider how to hold the AGM while taking account of public health measures concerning COVID-19 and ensuring we meet the legislative requirements in the 1997 Act relating to the holding of AGMs. Currently there is no provision in credit union legislation for the holding of hybrid or virtual AGMs. Dialogue is taking place between the Department of Finance and credit union representatives on the question of a possible legislative change by the Oireachtas. We will update you on this matter as information becomes available. Dividends and Interest Rebates 2020 Traditionally Black Raven has distributed generous Dividends and Interest Rebates to Members. The Pandemic has brought new conditions which need to be given careful consideration. On the 4th of September 2020, the Boards of Credit Unions and Management Teams received a letter from the Central Bank of Ireland. Point 2 of the letter refers to “Credit Union Distributions and Prudent Reserve Management”. The Bank have asked Credit Unions to consider the level of risk and uncertainty regarding the economic outlook brought about by the Pandemic. The Bank expect Credit Unions to consider increasing the Capital Reserves of each credit union and build these rather than proposing Dividends and Interest Rebates for the Financial year end 2020. Please check in with our website www.blackravencu.ie and our social media posts for up to date information. We will update you regularly over the coming weeks. Susan Lynch CEO | | | |

| |

.jpg) | | | We are delighted to launch our new 40th Anniversary Loan product. You can borrow between €500 - €2,000 over a maximum of 1 year. This is a one off limited offer so don’t miss out!!

Lending terms and conditions apply. Why not talk to us today by phone 01-4610682 or email loans@blackravencu.ie | | | | | | | | Sample repayments: Borrow €2000 over 12 months, APR 4.99%, 53 weekly repayments of €39.44. Total interest: €51.15 Total amount repayable €2051.15 | | | |

| |

TREAT YOURSELF OR A LOVED ONE THIS CHRISTMAS | | | | 2020 has been a tough year for us all, so why not treat yourself or a loved one this Christmas. Check out some of our Christmas present ideas below. For all loans big or small we’ve got you covered with our Christmas Loans. Contact us today by phone: 01-4610682 or by email: loans@blackravencu.ie * Note: We do not supply this equipment or guarantee prices. These are for illustrative purposes only, to show repayment costs for this item when you take out a loan with us. Sample repayments below are based on the standard loan rate of 8.99% (9.4% APR)

| | | | | | | |  | | |  | | |  | | |

| |

| | | | The December Prize Fund stands at €20,000 1st Prize - €5,000 2nd Prize - €2,000 8 prizes of €1,000 10 prizes of €500 Draw will take place on 1st December 2020.

Good Luck to all participants in our upcoming Christmas draw. | | | | | | | | | | | | | | | |

| |

| 40th ANNIVERSARY CHRISTMAS CASH DRAW | | | | .jpg) | | | As part of our 40th anniversary celebrations we will be holding an additional draw for €20,000 (20 prizes of €1,000). The draw will take place on 15th December 2020. Our Policy is to distribute all draw deductions back to members in the form of cash prizes.

''If you are not in you can't win''

| | | |

| |

CU ONLINE – A SAFE AND SECURE WAY TO ACCESS YOUR ACCOUNT 24/7 365 DAYS FROM THE COMFORT OF YOUR HOME | | | | Are you working from home? Did you know you can open an account and become a member today online? Did you know you can do most of your transactions online? Members can now not only view their account details and balances online, but also avail of features such as: - Become a member online

- Withdraw funds from your Share and Moneysave account through quick transfer on your online banking

- Quick loan application facility

- Draw down on your loan online using our digital signature facility

- View and download your statements

- Transfer funds between your Credit Union accounts

- Make payments and transfer funds to external payees

- Send a message directly to the credit union through the web messaging facility.

| | | | How to register for online access - Visit our website www.blackravencu.ie

- Select register tab at the top right of our website page

- Complete the online banking registration form

- You will create your own username and password, and we will send you a pin.

| | | | How to join online: - Visit our website www.blackravencu.ie

- Select the membership heading

- Go to Join online

- Complete online membership form

- Attach required documents

| | | | | |

| |

| Black Raven Credit Union – Supporting The People Who Help Your Local Community | | | |  | | |

Black Raven Credit Union is one of the Dublin Credit Unions who have joined forces with the Dublin Gazette, to do our part in raising awareness of the importance of supporting each other and supporting local businesses during these unprecedented times. We featured in the Dublin Gazette, recently.

| | | | | | | |

| |

| |

| |

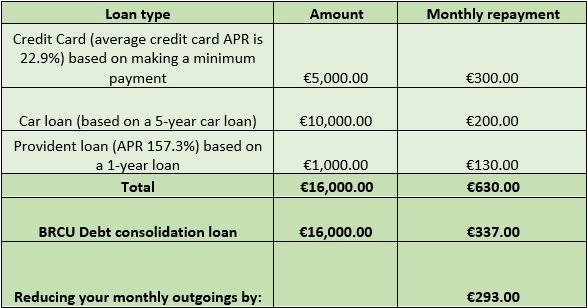

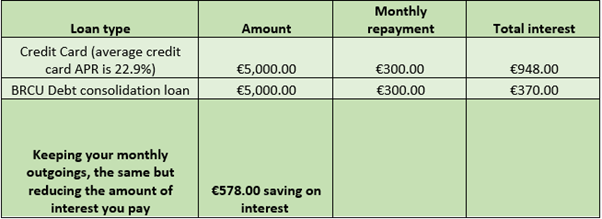

About Our Debt Consolidation Loan Switch and save with our debt consolidation loan! Would you like to pay off existing credit cards, loans and other outstanding debts and consolidate them into one easy, manageable loan? We are here to discuss a new financial plan with you. Call us at Black Raven Credit Union on 01 4610682, or email us at loans@blackravencu.ie Why Choose a Debt Consolidation Loan? - You could lower your monthly repayment costs and save money over the life of the loan

- You can have one manageable repayment

- You may be able to pay off your debt faster

- You can track and stay on top of your finances much easier

| | | | | |  | | |  | | |

| |

| BLACK RAVEN CREDIT UNION IS #LOVING❤LOCAL | | | |

Black Raven Credit Union is one of the Dublin Credit Unions who have joined forces to do our part in raising awareness of the importance of supporting each other and supporting local businesses during these unprecedented times. #StayLocalBorrowLocalSpendLocal is the message from your Credit Union, who are delighted to be part of the Dublin Gazette LOVING ❤LOCAL initiative. | | | |

| |

| |

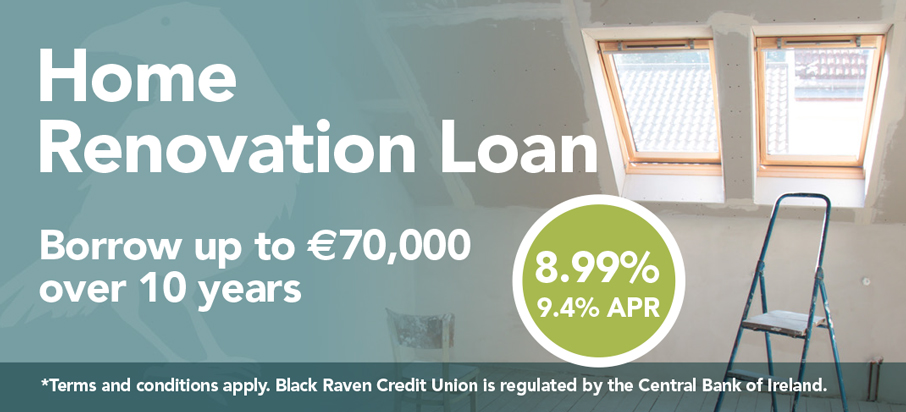

| IMAGINE A BIGGER, BRIGHTER OR GREENER HOME! | | | |  | | |

Are you dreaming of upgrading to a warmer home, improving your home energy efficiency or even making your home bigger & brighter? Well the answer might be just around the corner! Black Raven Credit Union is now making those home renovations even more affordable by spreading the repayment term up to 10 years.

We know that any renovation to your home can be stressful and we want to ensure that financing your home renovation project is not one of those stressful things. Start imagining the possibilities for your home with our Home Renovation Loan. Dream big because big plans don’t have to mean big payments. Benefits of going green - You can help the environment by reducing your carbon footprint and greenhouse gas emissions

- Lower energy bills

- Warmer home

- More energy efficient home

Why not talk to us today about our range of home improvement loans at 01-4610682 or email us at loans@blackravencu.ie Because all of your dreams that are big or small, we’ve got you covered with our home renovation loan. We are here to advise and assist with your lending needs. *Lending terms and conditions apply | | | | | | | |

| |

| | | IMAGINE OWNING THE CAR OF YOUR DREAMS! IMAGINE OWNING THE CAR FROM THE MINUTE YOU DRIVE OFF THE FORECOURT! Whether you’re dreaming of an upgrade, a hybrid, your very first car or even exiting from a PCP agreement, you’ll find our Special Car Loan rate very competitive. For a fair, flexible loan you won’t have to look far. This is a flexible, low cost loan available to our members. Lending terms and conditions apply. Why not talk to us today by phone 01-4610682 or email loans@blackravencu.ie | | | | | | | |

| |

| |

BE PREPARED THIS CHRISTMAS | | | |

Imagine not having to worry about upcoming Christmas expenses?

Imagine being prepared next year! Start saving in a Money Saver Account today.

| | | |

| |

Why not plan ahead for Christmas 2021. You can save in a Money Saver Account to budget for the upcoming costs or we can help relieve your stresses with a Christmas loan. Talk to us today about how to set up a Money Saver Account. Call us on 014610682 or email us at enquiries@blackravencu.ie | | | |

| |

HAVE YOU SET UP A NOMINEE ON YOUR ACCOUNT? | | | |

Please note the following: A nomination must be in writing The statutory maximum amount that is paid out under a nomination is currently €23,000. Any amount in excess of this balance becomes part of the deceased member’s estate. If you elect not to complete a nomination, the proceeds from your account will form part of your estate on your death and will be dealt with under the terms of your will, or if you have made no will, under the rules of intestacy or under the small payments provision. You may revoke or vary your nomination at any time by completing a new nomination form. A nomination is not revocable or variable by the terms of your will or by codicil to your will. A nomination is automatically revoked when your nominee dies before you. In this case, you should consider completing a new nomination. If you do not, your property in the credit union will form part of your estate.

| | | |

A nomination is a legally binding, written instruction that tells the Credit Union what to do with your money after your death. The member completes a Nomination Form which allows the member (nominator) to nominate a person/persons (nominees) to become entitled to any properties in the credit union in the event of their death. The nomination service is very valuable to members in that it allows access to nominated funds by the nominee within a very short time of the death of the member. While it will not relieve the loss suffered by the nominee, it could relieve any potential cash flow difficulties. What happens to my shares when I die? Members of the credit union can nominate a person to receive their credit union shares up to €23,000 on their death. If there is no nominated person, the proceeds of your account will form part of your estate on your death and will be dealt with under the terms of your Will. If you make no Will they it will be dealt with under the rules of intestacy or under the small payments provision. Grants of probates or letters of administration are often required to release the funds in the account where no nomination form has been completed. Who can I nominate? A member can nominate anyone – family member, friend or group of people. It is important that members review their nomination form regularly. Can I change my nomination? Yes, by filling out a new nomination form. A nomination becomes invalid if the member gets married or the nominee dies. It is a good idea therefore to review the nomination from time to time to ensure that the person(s) nominated is/are the most appropriate. Please note that divorce or legal separation will not revoke a nomination. Where do I get a nomination form? You can phone us on 01-4610682 or email enquiries@blackravencu.ie where a staff member can arrange sending you out a nomination form for completion. | | | |

A nomination is automatically revoked by your subsequent marriage. Please note that divorce or legal separation will not revoke a nomination. Where your personal circumstances change (e.g. marriage, divorce, separation), you should review your nomination at that time. | | | |

The nominated savings do not form part of a deceased person’s estate | | | |

| |

| |

Life is full of unexpected twists and turns. And though we do our best to plan for the road ahead, we never know what is around the corner. As a member of Black Raven Credit Union, you have access to some great insurance deals from CU Safe Insurance: Home Insurance From our partners CU Safe Insurance. GET HOME INSURANCE QUOTE Life Insurance From our partners CU Safe Insurance. GET LIFE INSURANCE QUOTE Mortgage Protection From our partners CU Safe Insurance. GET MORTGAGE PROTECTION QUOTE Car Insurance From our partners CU Safe Insurance. GET CAR INSURANCE QUOTE Travel Insurance From our partners CU Safe Insurance. GET TRAVEL PROTECTION QUOTE | | | |  | | |

| |

Black Raven Credit Union Limited is regulated by the Central Bank of Ireland | | | |

| |

| |

This email and any attachment are subject to copyright and are intended only for the named recipient. You are advised not to disclose the contents of this email to another person or take copies of it. This message is private and confidential. It must not be disclosed to, or used by anyone other than the addressee. If you receive this message in error, please notify the sender immediately. Although this email and any attachment are believed to be free from viruses, it is the responsibility of the recipient to ensure that they are virus free. Black Raven Credit Union Limited accepts no responsibility for any loss or damage arising in any way from their receipt, opening or use. Black Raven Credit Union Limited is regulated by the Central Bank of Ireland. | | | |